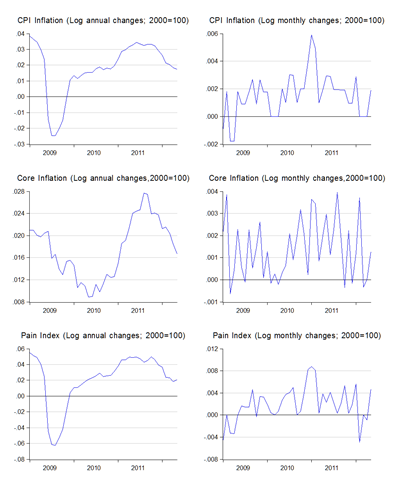

Consumer inflation for November continues to slow, though you can’t really tell from the chart (log annual and monthly changes):

Thursday, December 20, 2012

November 2012 Consumer Prices

Wednesday, December 19, 2012

Democracy And Natural Resources

In the popular imagination, democracy is the foundation for prosperity. Strong, trustworthy political and public institutions are a precondition for sustained economic growth and development. The empirical evidence however, is decidedly mixed – not a few studies find little to no evidence of a link, and some fund links going the other way i.e. income creates democracies but not the other way around.

This new working paper from the IMF partly explains why (abstract):

Income and Democracy: Lipset's Law Revisited

Hoeffler, Anke, and Bates, Robert H. & Fayad, GhadaSummary: We revisit Lipset‘s law, which posits a positive and significant relationship between income and democracy. Using dynamic and heterogeneous panel data estimation techniques, we find a significant and negative relationship between income and democracy: higher/lower incomes per capita hinder/trigger democratization. Decomposing overall income per capita into its resource and non-resource components, we find that the coefficient on the latter is positive and significant while that on the former is significant but negative, indicating that the role of resource income is central to the result.

Friday, December 14, 2012

Preschool Education: Public or Private? The Answer Is Both

We’ve started on the way to providing universal preschool education, but it’s still going to be a long road. At present, the Malaysian strategy is to incentivise private provision of pre-school education via grants and tax incentives, even though there does exist public funded pre-schools.

From last month’s round of NBER working papers, it appears that there’s a place for public pre-schools as well (abstract):

Does State Preschool Crowd-Out Private Provision? The Impact of Universal Preschool on the Childcare Sector in Oklahoma and Georgia

Daphna Bassok, Maria Fitzpatrick, Susanna LoebThe success of any governmental subsidy depends on whether it increases or crowds out existing consumption. Yet to date there has been little empirical evidence, particularly in the education sector, on whether government intervention crowds out private provision. Universal preschool policies introduced in Georgia and Oklahoma offer an opportunity to investigate the impact of government provision and government funding on provision of childcare. Using synthetic control group difference-in-difference and interrupted time series estimation frameworks, we examine the effects of universal preschool on childcare providers. In both states there is an increase in the amount of formal childcare. In Georgia, both the private and public sectors grow, while in Oklahoma, the increase occurs in the public sector only. The differences likely stem from the states’ choices of provision versus funding. We find the largest positive effects on provision in the most rural areas, a finding that may help direct policymaking efforts aimed at expanding childcare.

The point here is that both public and private-run pre-schools can co-exist, and the former won’t necessarily push out the latter. Another key point is that the largest impact of public pre-schools is in rural areas, where the private sector will be less likely to venture.

If we’re going to achieve universal pre-school education, thereby equalising investment in education for all our children and ensuring a true level playing field for economic opportunity (and hence reducing income and wealth inequality), public funded and run pre-schools would probably have to be part of the strategy.

Technical Notes

Bassok, Daphna; and Maria Fitzpatrick & Susanna Loeb, "Does State Preschool Crowd-Out Private Provision? The Impact of Universal Preschool on the Childcare Sector in Oklahoma and Georgia", NBER Working Paper No. 18605, December 2012

Thursday, December 13, 2012

3Q 2012 Federal Government Debt Update

Another quick update on the numbers. Federal government debt rose to RM484.6 billion as at the end of 3Q2012 (RM billions):

3Q 2012 Federal Government Finance

Just a quick update on the numbers – more for my own records and conscience than anything else.

Up to 3Q2012, the government has received 72.7% and spent 69.4% of the 2012 budget based on the latest estimates published two months ago (RM millions):

The budget deficit over the first three quarters of 2012 has averaged a little under RM7.5 billion a quarter, higher than the average RM5.7 billion from the same period in 2011 but substantially lower than the RM10.6 billion average for the full year in 2011.

Revenue growth averaged 9.4% while total expenditure climbed 11.8% – both numbers are below the 2011 full-year growth figures (16.1% and 12.3% respectively).

Wednesday, December 12, 2012

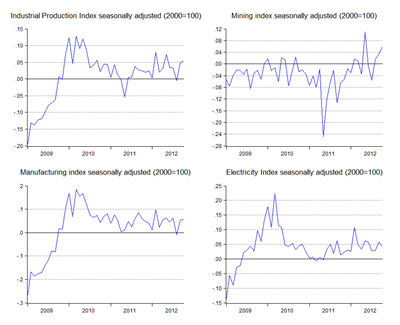

October 2012 Industrial Production

The October numbers for industrial production released yesterday came out pretty strong. How strong? They floored me, and you’ll see why in a sec (log annual and monthly changes; seasonally adjusted):

Tuesday, December 11, 2012

Reforming Bankruptcy Laws

I’ve always felt that the legal provisions for bankruptcy in Malaysia are too punitive. Seems like I have some company (excerpt):

...If the borrower or the guarantor (who is equally liable) has a debt of RM30,000 or more and has not been repaying that loan, the financial institution or creditor can institute bankruptcy proceedings to get their money back.

And it is tough being a bankrupt. When a person is declared a bankrupt, their existing bank accounts will be deactivated. This means they cannot withdraw money, open a new account or use their existing account unless they get permission from the Director-General of Insolvency (DGI). Their assets will be frozen and sold off to pay the debtors; they are unable to get new loans or travel overseas (unless they get written permission from the DGI) and can only use a credit of up to RM1,000 on an existing credit card. Their standing in society is damaged and they can forget about any political ambitions as they would not be allowed to stand for elections.

According to Rembau MP and Umno Youth chief Khairy Jamaluddin, who has been pushing for a review of the Bankruptcy Law to give people a second chance, Malaysia has one of the most stringent bankruptcy laws in the world...

Monday, December 10, 2012

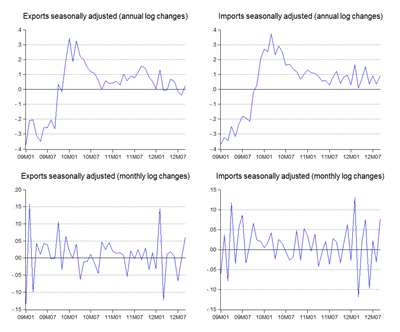

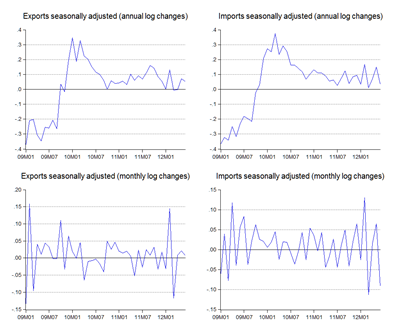

October 2012 External Trade

What goes up must come down, or something like that. I didn’t think many believed that last month’s trade growth numbers were sustainable, and so it has proved (log annual and monthly changes; seasonally adjusted):

On the whole, trade looks like its just treading water, though there’s a lot of heterogeneity in the numbers – ASEAN and US exports are up, but China and Europe are down.

Friday, December 7, 2012

Rank And File: The Corruption Perception Index

You can’t miss it in the news over the past few days – Malaysia’s ranking in Transparency International’s Global Corruption Perception Index has “improved” from 60th in 2011 to 54th. Or has it?

A friend told me the methodology had changed, and so it has (details here; warning: pdf link). This made me a little upset, because its clear that most of the work I put in for this series of posts was mostly wasted.

More relevant still, its also clear that the CPI rankings in previous years are pretty much worthless for tracking both corruption and the perception of corruption over time.

Thursday, December 6, 2012

October 2012 Monetary Conditions

I was looking at liquidity conditions, and found something interesting, but I’ll get to that in a bit. M1 growth decelerated sharply in October, although M2 showed a slight uptick in growth (log annual and monthly changes; seasonally adjusted):

Wednesday, November 28, 2012

Jomo On Jobs

I’m sorry to say I never took Jomo’s class when I was doing my masters. I regret that even more deeply now (excerpt):

Stronger recovery, more jobs for all

Comment by Jomo Kwame SundaramGREATER international cooperation and coordination is urgently needed for a more robust and sustained recovery, with benefits far more widely shared. The United Nations (UN) has long argued that only a sustained commitment to prioritising economic recovery can overcome the short termism dictated by financial markets.

Recovery priorities should emphasise job creation as well as enhancing national productive capacities through public investment in infrastructure, for example, which induces complementary private investments and creates the conditions for sustained growth over the longer term. This necessarily requires ensuring greater coherence of macroeconomic policies with structural transformation goals than seen thus far.

BNM Watch: Is Zeti A Closet Market Monetarist?

Perhaps not operationally, but philosophically it sure sounds like it (excerpt):

Zeti: Malaysia wants steady growth, it is necessary to sustain and improve economy

KUALA LUMPUR: Malaysia wants to have steady growth that will allow it to sustain and improve its economic position, Bank Negara governor Tan Sri Dr Zeti Akhtar Aziz said.

She said the country did not want high growth in one year and a very low one the following year.

Zeti said this on the sideline of the 2nd International Shariah Research Academy for Islamic Finance (ISRA) Colloquium 2012 here. She was asked whether the country could sustain strong growth next year.

She said the domestic economy was still strong and resilient…

…Zeti added that Malaysia was in a good economic position from its initiatives and reforms over the last decade after the Asian financial crisis. Nevertheless, she said it would have to do much more to prepare for future disruptions that might be experienced by international financial markets and possible economic slowdown in different economies of the world.

Friday, November 23, 2012

September 2012 Employment Report

Unemployment took a hit in September, as the end of Ramadhan meant more people looking for work, but not quite enough jobs to go around (‘000):

Thursday, November 22, 2012

3Q2012 National Accounts: Defying Gravity

Well, I’m back from my break, and what an interesting bunch of numbers to come back to. The national accounts data released last Friday showed the economy chugging along at 5.2% in 3Q2012 (log annual and quarterly changes, seasonally adjusted):

There really hasn’t been much variation in the growth numbers either on an annual or quarterly basis since the beginning of 2011, indicating a trending economy.

Wednesday, November 21, 2012

Masters of Money Part III

[I’m on annual leave from 17-21 November. This post is scheduled as a filler]

There’s a three-part documentary on the BBC entitled the Masters of Money, looking at the lives, ideas and times of three great economic thinkers – John Maynard Keynes, Friedrich August Hayek and Karl Heinrich Marx.

This is part III on Marx:

[H/T: The Social Democracy For The 21st Century: A Post Keynesian Perspective blog]

Tuesday, November 20, 2012

Masters of Money Part II

[I’m on annual leave from 17-21 November. This post is scheduled as a filler]

There’s a three-part documentary on the BBC entitled the Masters of Money, looking at the lives, ideas and times of three great economic thinkers – John Maynard Keynes, Friedrich August Hayek and Karl Heinrich Marx.

This is part II on Hayek:

[H/T: The Social Democracy For The 21st Century: A Post Keynesian Perspective blog]

Monday, November 19, 2012

Masters of Money Part I

[I’m on annual leave from 17-21 November. This post is scheduled as a filler]

There’s a three-part documentary on the BBC entitled the Masters of Money, looking at the lives, ideas and times of three great economic thinkers – John Maynard Keynes, Friedrich August Hayek and Karl Heinrich Marx.

This is part I on Keynes:

[H/T: The Social Democracy For The 21st Century: A Post Keynesian Perspective blog]

Friday, November 16, 2012

Alvin Roth, Game Theory And Economic Policy Design

In case you missed it, Alvin Roth, recent co-winner of the 2012 Nobel Prize in Economics, was interviewed this Wednesday past on BFM:

What's the relevance here? One of the problems with designing public policies is that most of the outcomes in the areas of interest that are being targeted aren't within functioning markets where prices provide signals and coordinate the allocation of resources. While economic theory can and does provide some guidance, just trying to reproduce a functioning market within milieus that don't support them has, shall we say, met with mixed results.

That's where game theory comes in - it's a way to look at the responses of participants to particular situations and stimuli. Or as Mankiw would probably put it, people respond to incentives. Game theory is thus a way to model and look at non-price incentives, although that's probably too narrow a definition (I'm looking at it purely in policy terms).

In policy design, what I think is that policies for non-market based environments (for example reducing government red tape or getting teachers more involved with their students where there is little to no monetary incentive), should have game theoretic foundations. Too often I think, policies are based on the gut feeling of the policy makers involved, or whichever consultant or management fad happens to be the flavour of the day (*cough* Blue Ocean Strategy *cough*).

I'm not knocking the good intentions of the people involved, or their expertise, but I think game theory has a lot to offer if we're only willing to leverage on its capabilities.

Lars Christensen on Malaysia

I haven’t got much time today, but I got an email from Lars last night on his post, and I thought it would be of interest to many (excerpt):

Malaysia should peg the renggit to the price of rubber and natural gas

The Christensen family arrived in Malaysia yesterday. It is vacation time! So since I am in Malaysia I was thinking I would write a small piece on Malaysian monetary policy, but frankly speaking I don’t know much about the Malaysian economy and I do not follow it on a daily basis. So my account of how the Malaysian economy is at best going to be a second hand account.

However, when I looked at the Malaysian data something nonetheless caught my eye. Looking at the monetary policy of a country I find it useful to compare the development in real GDP (RGDP) and nominal GDP (NGDP). I did the same thing for Malaysia. The RGDP numbers didn’t surprise me – I knew that from the research I from time to time would read on the Malaysian economy. However, most economists are still not writing much about the development in NGDP.

In my head trend RGDP growth is around 5% in Malaysia and from most of the research I have read on the Malaysian economy I have gotten the impression that inflation is pretty much under control and is around 2-3% – so I would have expected NGDP growth to have been around 7-8%. However, for most of the past decade NGDP growth in Malaysia has been much higher – 10-15%…

I won’t comment much on this…yet…because like Lars I’m due for a holiday, and won’t be back til late next week. But this is an interesting outsider’s perspective and an application of market monetarist views to monetary policy in Malaysia.

I have some substantive thoughts on the subject, but with work and the GDP release due this afternoon, I’ll have to leave it until I get back on Thursday next. Suffice to say, I’m not that keen on using the Ringgit as the primary monetary policy instrument.

Wednesday, November 14, 2012

The Spread Of Islam: An Economic Perspective

Given the holiday tomorrow in conjunction with the Islamic New Year, this new NBER research paper is really appropriate (abstract):

Trade and Geography in the Origins and Spread of Islam

Stelios Michalopoulos, Alireza Naghavi, Giovanni PraroloThis research examines the economic origins and spread of Islam in the Old World and uncovers two empirical regularities. First, Muslim countries and ethnic groups exhibit highly unequal regional agricultural endowments. Second, Muslim adherence is systematically higher along the pre-Islamic trade routes. We discuss the possible mechanisms that may give rise to the observed pattern and provide a simple theoretical argument that highlights the interplay between an unequal geography and proximity to lucrative trade routes. We argue that these elements exacerbated inequalities across diverse tribal societies producing a conflictual environment that had the potential to disrupt trade flows. Any credible movement attempting to centralize these heterogeneous populations had to offer moral and economic rules addressing the underlying economic inequalities. Islam was such a movement. In line with this conjecture, we utilize anthropological information on pre-colonial traits of African ethnicities and show that Muslim groups have distinct economic, political, and societal arrangements featuring a subsistence pattern skewed towards animal husbandry, more equitable inheritance rules, and more politically centralized societies with a strong belief in a moralizing God.

Monday, November 12, 2012

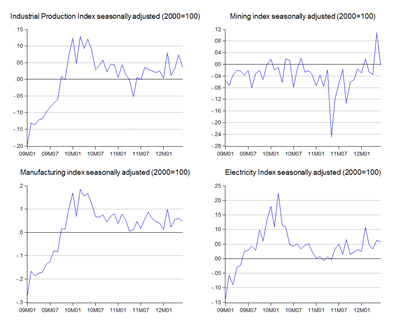

September 2012 External Trade

Last week’s trade numbers (released Friday) show the same bounce that affected industrial production (log annual and monthly changes; seasonally adjusted):

Friday, November 9, 2012

The Importance Of Early Education: More Evidence

From last month’s round of NBER research (abstract, emphasis added):

The Production of Human Capital: Endowments, Investments and Fertility

Anna Aizer, Flávio CunhaWe study how endowments, investments and fertility interact to produce human capital in childhood. We begin by providing empirical support for two key features of existing models of human capital: that investments and existing human capital are complements in the production of later human capital (dynamic complementarity) and that parents invest more in children with higher endowments due to the complementarity between endowments and investments (static complementarity).

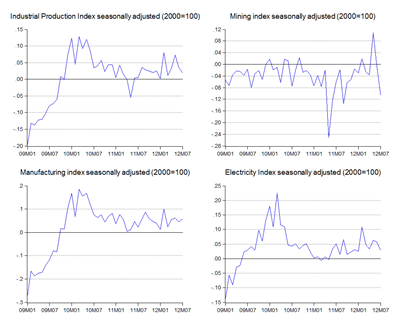

September 2012 Industrial Production

Well, well, thing are looking a bit brighter now. September 2012 industrial production numbers hint that 3Q2012 growth is likely to be stronger than originally anticipated (log annual and monthly changes; seasonally adjusted):

Monetary Policy Update: OPR Maintained At 3%

No surprises from yesterday’s announcement, and the press release for the announcement was probably the briefest this year in terms of describing economic conditions (excerpt):

At the Monetary Policy Committee (MPC) meeting today, Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 3.00 percent.

The global economy is expected to continue to experience slow growth…

…In the Malaysian economy, the sustained expansion in domestic activity has offset the weaknesses in the external sector. Looking ahead, private consumption will be supported by the income growth and stable employment conditions. Investment is expected to remain firm, led by increased capital spending in the domestic-oriented sectors, the oil and gas sector and the on-going implementation of infrastructure projects.

Headline inflation is expected to remain moderate for the remainder of 2012. While inflation may increase in 2013, it is expected to remain modest given the excess capacity in the economy…

There’s not much that can be added to that, though it does suggest somewhat that the MPC is looking at growth being sustained at current levels over the near term, which I interpret to mean in the 4.5%-5.5% region which is about where Malaysia’s medium term potential output path is.

Wednesday, November 7, 2012

The Redskins Rule: First (Second) Failure

Well, most of the results are in and it appears that Obama has won a second term as the President of the US, and beaten the Redskins rule.

This is just the second time the Redskins rule has failed to predict the winner (the first was in 2004), though a previous modification to the rule might still be valid – that the Redskins rule predicts the popular vote, but not necessarily voting in the electoral college.

Whatever the case, I’m pretty happy with the result. Whatever his other virtues might have been, Romney as president would have likely have meant a more aggressive (and populist) US foreign and trade policy and worsening income inequality in the world’s biggest economy. Neither is to be wished for.

Tuesday, November 6, 2012

FT Looking For Researchers

The UK based business paper the Financial Times is looking for a researcher to cover the Malaysian market:

The role will require candidates to analyse investment trends in their countries of coverage and be adept at handling and analysing data.

Candidates must write well, have an excellent command of English and be fluent in the local language in the city where they will be based. The successful candidates will be part of a small team and must be reliable and diligent. They must also show initiative and be able to work to tight deadlines.

Candidates who are passionate about economics and finance, and can write well are preferred. Salaries will be competitive.

If you’re interested, click through this link to apply. Deadline’s November 22 so you’d better hurry.

Race Discrimination In Hiring Part III

Continuing on from Friday’s post, the following speaks for itself:

Letter to the Editor — Lee Hwok Aun and Muhammed Abdul Khalid

NOV 6 — Dear Sir

Your headline, “Malaysian employers practise racial bigotry, study shows” (November 2nd, 2012), grossly misrepresents our study. It is unfortunate that you projected a sensationalised, emotive and reckless headline that vastly deviates from our objective, methodical and dispassionate work.

September 2012 Monetary Conditions

I haven’t done one of these in quite a while, mostly through sheer lack of time, but given the upcoming Monetary Policy Committee meeting this Thursday, now is as good time as any to reboot.

Over the last quarter, broad money supply growth has fallen off (log annual and monthly changes; seasonally adjusted):

Race Discrimination Part II

As a follow up to the other day's post, one of the authors of the study on race discrimination in hiring, Lee Hwok Aun, was on BFM radio yesterday. So if you want the nitty-gritty, straight from the horse's mouth so to speak, have a listen:

Race and access to job interviews

Monday, November 5, 2012

Newsflash: The Redskins Lost, So Probably Will Obama

Here’s a statistical oddity that has held mostly true over the past century – the result of the last home game of the Washington Redskins has been almost perfectly correlated with the outcome of the US Presidential election for the last 80 years.

If the Redskins won, the incumbent party has also won. If the Redskins lose, the challenging party won.

This weekend’s home game result? Carolina 21, Washington 13.

If the correlation runs true, I’m afraid the Obama experiment is over. Voting starts Tuesday in the US (Wednesday here in Malaysia).

Friday, November 2, 2012

Race Discrimination In Hiring Practices In Malaysia

You’ll probably read about this in the papers tomorrow or Sunday (the Malaysian Insider has the scoop today – just ignore the headline, it’s not accurate), but I attended a very interesting seminar this morning at Universiti Malaya.

The topic: “Does race matter in getting an interview? A field experiment of hiring discrimination in Peninsular Malaysia”

Tuesday, October 30, 2012

Latest GFI Report: Illicit Capital Flows Through China

The latest from Global Financial Integrity focuses on illicit outflows and inflows revolving around China (excerpt from press release):

Illicit Financial Flows from China and the Role of Trade Misinvoicing

The Chinese economy hemorrhaged US$3.79 trillion in illicit financial outflows from 2000 through 2011, according to a new report [PDF] released today by Global Financial Integrity (GFI), a Washington, DC-based research and advocacy organization. Amidst increased domestic concern over inequality and corruption, GFI’s study raises serious questions about the stability of the Chinese economy merely two weeks before the once-in-a-decade leadership transition…

Monday, October 29, 2012

It Pays To Be Popular

This is a blow to nerds everywhere (abstract):

Popularity

Gabriella Conti, Andrea Galeotti, Gerrit Mueller, Stephen PudneyWhat makes you popular at school? And what are the labor market returns to popularity? We investigate these questions using an objective measure of popularity derived from sociometric theory: the number of friendship nominations received from schoolmates, interpreted as a measure of early accumulation of personal social capital. We develop an econometric model of friendship formation and labor market outcomes allowing for partial observation of networks, and provide new evidence on the impact of early family environment on popularity. We estimate that moving from the 20th to 80th percentile of the high-school popularity distribution yields a 10% wage premium nearly 40 years later.

Friday, October 26, 2012

Eid Mubarak

I’m on a break until Monday. To all Muslim brothers and sisters, Eid Mubarak, and for everyone else, have a good holiday. If you’re driving, stay patient and stay safe.

Wednesday, October 24, 2012

And Now For Something Completely Different…

Happiness is seven apples a day (abstract):

Is Psychological Well-being Linked to the Consumption of Fruit and Vegetables?

Humans run on a fuel called food. Yet economists and other social scientists rarely study what people eat. We provide simple evidence consistent with the existence of a link between the consumption of fruit and vegetables and high well-being. In cross-sectional data, happiness and mental health rise in an approximately dose-response way with the number of daily portions of fruit and vegetables. The pattern is remarkably robust to adjustment for a large number of other demographic, social and economic variables. Well-being peaks at approximately 7 portions per day. We document this relationship in three data sets, covering approximately 80,000 randomly selected British individuals, and for seven measures of well-being (life satisfaction, WEMWBS mental well-being, GHQ mental disorders, self-reported health, happiness, nervousness, and feeling low). Reverse causality and problems of confounding remain possible. We discuss the strengths and weaknesses of our analysis, how government policy-makers might wish to react to it, and what kinds of further research -- especially randomized trials -- would be valuable.

David G. Blanchflower, Andrew J. Oswald, Sarah Stewart-Brown

What can I say? Eat your fruits and vegetables.

I’m definitely saving this one to show my daughter.

Technical Notes

Blanchflower, David G., and Andrew J. Oswald & Sarah Stewart-Brown, "Is Psychological Well-being Linked to the Consumption of Fruit and Vegetables?", NBER Working Paper No. 18469, October 2012

August 2012 Employment Report

Monday’s report on employment shows Malaysia’s labour market shedding 200k jobs (‘000):

Looking at the chart above, I can’t help but think this is just statistical noise – the change in employment series looks suspiciously regular. The feeling I get from this has been made even stronger because of the lack of breakdown in the monthly employment and labour force data. In that sense, the quarterly employment surveys might be a more accurate reflection of the actual state of the labour market.

Having said that, I appreciate having a monthly series to look at, even if it is “noisy”.

Monday, October 22, 2012

September 2012 Consumer Prices

Consumer price inflation continued to slow marginally in September (log annual and monthly changes; 2000=100):

Wednesday, October 17, 2012

The Economist On Inequality

The bastion of free market thinking tackles inequality (excerpt):

Inequality and the world economy

True ProgressivismA new form of radical centrist politics is needed to tackle inequality without hurting economic growth

BY THE end of the 19th century, the first age of globalisation and a spate of new inventions had transformed the world economy. But the “Gilded Age” was also a famously unequal one, with America’s robber barons and Europe’s “Downton Abbey” classes amassing huge wealth: the concept of “conspicuous consumption” dates back to 1899.

Japan’s Lost Decades? Not Quite

From the East Asia Forum (excerpt):

The missing piece in the puzzle of Japan’s lost decades

Ippei FujiwaraJapan’s average GDP growth rate was around 9.5 per cent between 1955 and 1970, and 3.8 per cent between 1971 and 1990.

But in the past two decades it has dropped to just 0.8 per cent a year. This big drop in the growth rate is synonymous with ‘Japan’s two lost decades’…

Tuesday, October 16, 2012

Teacher Quality: Compensation Or Self-Selection?

Now here’s something that ought to be used as input into the National Education Blueprint (abstract):

Teacher Quality Policy When Supply Matters

Jesse RothsteinRecent proposals would strengthen the dependence of teacher pay and retention on performance, in order to attract those who will be effective teachers and repel those who will not. I model the teacher labor market, incorporating dynamic self-selection, noisy performance measurement, and Bayesian learning. Simulations indicate that labor market interactions are important to the evaluation of alternative teacher contracts. Typical bonus policies have very small effects on selection. Firing policies can have larger effects, if accompanied by substantial salary increases. However, misalignment between productivity and measured performance nearly eliminates the benefits while preserving most of the costs.

2012 Nobel Prize In Economics

It’s that time of the year again. This year’s award is again shared:

Press Release

15 October 2012The Royal Swedish Academy of Sciences has decided to award The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel for 2012 to

Alvin E. Roth

Harvard University, Cambridge, MA, USA, and Harvard Business School, Boston, MA, USAand

Lloyd S. Shapley

University of California, Los Angeles, CA, USA"for the theory of stable allocations and the practice of market design".

Monday, October 15, 2012

Perspectives On Fiscal Austerity

Businessweek is highlighting the IMF’s nervousness over the impact of fiscal austerity in Europe (excerpt):

More From Olivier Blanchard, the IMF's Dovish Economist

Under Olivier Blanchard, its chief economist, the International Monetary Fund has transformed itself from a strong voice for strict austerity to a strong voice against strict austerity. The latest example is an explanatory box in the IMF’s World Economic Outlook. In it, Blanchard and IMF economist Daniel Leigh present research showing that deficit reduction has harmed growth far more than is commonly understood.

The research (in box 1.1) is technical, but the big idea is that Blanchard and Leigh compared forecasts of nations’ economic growth with what actually happened after countries tightened their belts. They found consistently that growth came in worse than expected, which means that the belt-tightening was more harmful than economists believed it to be—by a lot. Economists have assumed that cutting the government deficit by 1 percentage point cuts about half a percentage point off economic output, but the actual decline is more like 0.9 percentage points to 1.7 percentage points, Blanchard and Leigh write.

OPR Speculation

From the Star today (excerpt):

Will Bank Negara cut interest rates next month?

PETALING JAYA: Will Bank Negara seriously look into cutting benchmark interest rates in November's monetary policy committee meeting given the deteriorating external conditions and moderating domestic front in recent months or will it continue to signal a stable rates outlook?

Most economists expect the central bank to continue keeping the overnight policy rate (OPR) on hold at 3% in November (the last meeting of the year), although a hint of caution has entered into its policy statements since July on the external environment amid signs of moderation on the domestic front…

Friday, October 12, 2012

Everything You Wanted To Know About Qualitative Easing

It took me a minute to realise that this new paper I was reading wasn’t a tract about Quantitative Easing, but about Qualitative Easing.

What’s the difference? Quantitative easing refers to the creation of new money that is then used to purchase risky bonds and other securities, thus expanding a central bank’s balance sheet and injecting liquidity into the financial system. Qualitative easing on the other hand refers to the purchase of risky bonds and other securities with higher quality securities such as government bonds or central bank papers. In this case, there’s no increase in a central bank’s balance sheet, and no additional injection of liquidity into the system.

A Singaporean Mystery (Partially) Explained

Three months back, I highlighted some issues raised by Prof Christopher Balding regarding Singapore’s public finances. Somewhat unusually, the Singapore government has deigned to publish a public rebuttal (excerpt):

Is there something wrong with our Reserves?

From time to time, there are claims that the Singapore Government is covering up losses in our reserves, or that Singaporean CPF monies are not safe. Some recent online postings have even claimed that GIC and/or Temasek are reporting false returns to cover up losses, or that the Government siphons monies from its Budget or from Government borrowings so as to pad up GIC and Temasek’s books.

The Government does not publish the size of assets managed by GIC, although the asset size of MAS and Temasek are published. On the basis of the information that the Government has published, as well as the full system of checks and balances, these recent claims are baseless. Indeed, they are fantastical, but let’s look at some basic facts…

August 2012 Industrial Production

The IPI report is early this month, but that’s not necessarily good news. Apart from mining, the numbers are all looking down (log annual and monthly changes; seasonally adjusted):

Wednesday, October 10, 2012

Changing The Teaching Of Economics

There’s been a lot of criticism about the economics profession in the last 5-6 years. Why didn’t we forsee the Great Recession coming? Why is there continued debate on the best way out of this mess? Why is there such disagreement over specific policies, and for that matter, what has happened and is happening now? Is there in essence, something fundamentally wrong with economics?

There’s a new debate on VoxEU that aims to realise that old adage – physician, heal thyself – especially with reference to the teaching of economics and young economists (excerpt; emphasis added):

What’s the use of economics? Introduction to the Vox debate

Diane Coyle, 19 September 2012If economics emerges from the Global Crisis unchanged, it will lose all credibility. That is certainly not the view of all economists, but many do think so…

…However, it is not obvious what shape an effective response to even well-founded criticisms could take…

…One starting point…is the teaching of economics, beginning with the undergraduate level…

Friday, October 5, 2012

August 2012 External Trade

As I foresaw last month, the changing structural composition of Malaysia’s imports means that the long-standing statistical relationship between exports and imports has broken down this year.

With capital goods taking on a greater weight in the import breakdown, the export forecasts generated by imports as an explanatory variable is now consistently higher than realisation (RM millions):

Budget 2013: A Head To Head Comparison

This was supposed to come out a couple of days ago, but I was just to busy to write this post. Better late than never I suppose.

In any case, what follows is a look at both the official and opposition budget proposals head to head (hereinafter called OB and AB). First, in terms of revenue:

Monday, October 1, 2012

Budget 2013: Some Thoughts

I’m frankly suffering from budget fatigue. There’s a lot of analysis in the news, and many conflicting opinions based on very different perspectives. For my part, this is more a commentary of the commentary, rather than talking about the budget directly. That analysis I’m planning to look at tomorrow.

One thing in the commentary that’s struck me, is the rather strange expectation that the budget is some kind of policy and strategy platform. You hear people expressing disappointment that industrial and SME development isn’t being touched on, or the absence of strategies to combat corruption, or the lack of info on how we are going to improve education.

This betrays a fundamental misunderstanding of what the budget is and supposed to do: allocate government expenditure for the year ahead.

Friday, September 28, 2012

Live-blogging Budget 2013 [UPDATED]

As I’ve tried to do in the past, I’ll be hoping to live-blog the budget announcement this afternoon. However, I’m on standby for something else, which may mean this plan might go out the window – but in that case, I’ll be going “live” in a very real sense.

So watch this space.

[I’m adding corrections to some of the items below, based on the released text of the speech. You can get the English version here, Bahasa version here. If you want an online version, try The Mole]

Pakatan Rakyat’s Alternative Budget

Good luck finding coverage of PR’s Alternative Budget (hereinafter referred to as AB; link here) in the mainstream media. And the commentary from the other side has been, shall we say, less than complimentary. I for one, however, am not going to call it “stupid”. There is some gold in the dross.

[For foreign readers, what’s being discussed here is not the official government budget, which will be tabled this afternoon. Rather, this is the “shadow” budget presented by the opposition and distributed on Sept 26th]

I’ve made some preliminary comments in my previous post if you care to read those (too lazy to repeat myself).

Comments will be stream of consciousness stuff, because I haven’t the time today to organise things, what with the “official” budget this afternoon.

Thursday, September 27, 2012

KJ On Buku Jingga

With the 2012 Federal Government budget set to be tabled in Parliament tomorrow, the papers are full of commentary on what people want, and what the government should be doing (though at this stage, it’s probably a little late to make further suggestions).

The Pakatan Rakyat’s 2010 Buku Jingga on the other hand is the coalition’s statement of principles on what it would do if it ever gained power. There are some good proposals and some not so good ones, but the main problem with it is that it was very light on details.

There’s also further policy proposals that have been mooted since, like free tertiary education and the relatively new proposal to phase out the very high excise duties on cars in Malaysia.

But there’s hardly any numbers placed on these policy initiatives until very, very recently (I’ll get to that later). Here’s KJ’s take on the matter in The Edge on Monday (excerpt):

Wednesday, September 26, 2012

Capital Flows Inside MNCs

A new research paper from the NBER working paper series looks at debt-shifting within MNCs, and finds that – surprise! – tax rates matter a great deal more than previously thought (abstract):

Corporate Taxes and Internal Borrowing within Multinational Firms

Peter Egger, Christian Keuschnigg, Valeria Merlo, Georg WamserThis paper develops a theoretical model of multinational firms with an internal capital market. Main reasons for the emergence of such a market are tax avoidance through debt shifting and the existence of institutional weaknesses and financial frictions across host countries. The model serves to derive hypotheses regarding the role of local versus foreign characteristics such as profit tax rates, lack of institutional quality, financial underdevelopment, and productivity for internal debt at the level of a given foreign affiliate. The paper assesses hypotheses in a panel data-set covering the universe of German multinational firms and their internal borrowing. Numerous novel insights are gained. For instance, the tax-sensitivity found in this paper is many times higher than previous research suggests. This accrues mainly to three things: the consideration of the boundedness of the internal debt ratio as a dependent variable in comparison to its treatment as an unbounded variable in most of the previous work; the coverage of all (small and large) multinationals here rather than a focus on large units in previous work; and the inclusion of endogenous characteristics in other countries multinationals are invested in (due to endogenous weights) while previous work did not consider such effects at all or assumed them to be exogenous. Moreover, local and foreign (at other locations of a given affiliate) market conditions matter more or less symmetrically and in the opposite direction. There is a nonlinear trade-off between institutional quality or financial development on the one hand and higher profit tax rates on the other hand, and the strength of this trade-off depends on the characteristics of one location relative to the other ones a multinational firm has affiliates (or the headquarters) in.

Economics For Entrepreneurs

A Professor of Entrepreneurial Studies thinks microeconomics should be inflicted on would-be business leaders (excerpt):

More Dismal Science for Would-Be Entrepreneurs

By Scott ShaneTeaching entrepreneurship is a growth business for U.S. business schools. The number of the nation’s undergraduate entrepreneurship programs grew 15.3 percent from 2007 to 2011, while the number of master’s programs increased 19.1 percent, according to the Association to Advance Collegiate Schools of Business.

Much of the curriculum in these programs focuses on evaluating one’s entrepreneurial potential, understanding the process of starting a business, writing business plans and financial statements, and raising money. While providing this information helps many students, my experience as an educator and investor has convinced me that entrepreneurship programs would do well to expose their students to more microeconomics.

Tuesday, September 25, 2012

When Is A Return Not A Return?

When investing in an international commodity, it really, really matters what currency you’re investing in. Exhibit one (excerpt):

Gold outshines equity, other asset class

NEW DELHI: Gold has witnessed a golden era in terms of returns to investors amid its skyrocketing prices as compared with the share market, which has given negative returns on investments in the last three years, a study revealed.

Monday, September 24, 2012

July 2012 Employment Update

Last week’s employment figures shows employment growth hitting 200k jobs for July – but so did labour force growth:

Tax Avoidance: Intellectual Property Edition

The tech industry is innovative in more ways than one, and has found quite a tax dodge (excerpt):

Microsoft and HP rapped by US Senate over tax havens

The US Senate has criticised Microsoft and Hewlett-Packard for their use of tax avoidance schemes, which it says is rampant in the tech sector.

The Senate's Permanent Subcommittee on Investigations said the companies used places such as the Cayman Islands so they did not have to pay US taxes…

…Microsoft and HP denied any wrongdoing…

Thursday, September 20, 2012

August 2012 Consumer Prices: Bottoming Out

For the first time in over a year, consumer inflation in Malaysia has stopped decelerating (log annual and monthly changes):

Wednesday, September 19, 2012

Global Growth: One Moment In Time

Bob Gordon argues that the past two centuries or so represent a unique period in human history (excerpt):

Is US economic growth over? Faltering innovation confronts the six

Robert J. Gordon, 11 September 2012It is time to raise basic questions about the process of economic growth, especially the assumption – nearly universal since Solow’s seminal contributions of the 1950s (Solow 1956) – that economic growth is a continuous process that will persist forever.

- There was virtually no growth before 1750;

- There is no guarantee that growth will continue indefinitely.

Low Interest Rates ≠ Loose Monetary Policy

An interesting, but misleading, viewpoint from the Beeb (excerpt):

Lesson from Japan: Do low interest rates boost growth? By Mariko Oi BBC News, Tokyo

…In part to help small companies such as Hosobuchi, central bankers in Japan have been keeping interest rates low, in order to reduce their borrowing costs.

The truth is we don't have enough businesses or the need for investments to borrow the money”

Japanese interest rates have been close to zero since the mid-90s, but it has not offered a miracle cure.

Tuesday, September 18, 2012

The IMF On Asia’s Near Term Prospects

Naoyuki Shinohara, the Deputy Managing Director of the IMF on Asia (excerpt; emphasis added)

Will Asia Remain Resilient to Global Economic Headwinds? Near-term Economic Prospects and Risks

As you know, external factors have played a major role in Asia, while domestic demand so far has remained fairly resilient. Spillovers from Europe have caused a marked export slowdown, as well as in a decline in net capital inflows despite their most recent rebound.

However, financial markets stress today is lower compared to about a year ago. In particular, a number of steps have been taken by Euro area officials, and a number of important announcements have been made, that have helped stabilize the situation...

Friday, September 14, 2012

OMG! QE3 To Boost Inflation…Not

The Federal Reserve Open Market Committee yesterday announced a third round of quantitative easing (excerpt; emphasis added):

…The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative…

Basically, the Fed is committing to increase its balance sheet size by USD85 billion every month – sounds like a lot, but its actually only about a 11.3% expansion of the Federal Reserve system’s USD2.8 trillion consolidated balance sheet from now until the end of the year.

(Details in the Fed’s plans are available here).

Thursday, September 13, 2012

Evaluating Teachers

Considering the timing with the National Education Blueprint coming out two days ago, the following article’s pretty much on the money. No comments from me, just wanted to share – hit the link for the full monty:

We Evaluate Doctors. Why Not Chicago Teachers?

Can teacher evaluations be done horribly wrong? Of course. Evaluating teachers solely on the basis of their students’ scores on standardized tests can accidentally penalize good teachers while rewarding bad ones. It also gives teachers a strong incentive to teach to the test, which encourages what New York educator Kate McKeown calls RAMIT: “regurgitate, acculturate, memorize, isolate, and threaten.”

But to say that evaluation can be done wrong is not to say it should never be attempted. We evaluate doctors. Why not Chicago teachers?…

July 2012 Industrial Production: Not Good

I’ve had a busy time the last two days, hence haven’t been able to cover this when the data came out.

Monday’s industrial production report from DOS paints a picture of tepid growth (log annual and monthly changes; seasonally adjusted):

Monday, September 10, 2012

I Agree With Soros: At Least, With Regard To The Euro

Soros thinks Germany is leading the Euro into dissolution (excerpt):

Soros calls for Germany to 'lead or leave euro'

International financier George Soros has called for Germany to "lead or leave the euro" days before a crucial ruling on the eurozone's bailout fund by Germany's constitutional court.

Mr Soros argued that the eurozone should target 5% economic growth.

That would require the bloc to abandon German-backed austerity measures and accept higher inflation, he says.

He also backed a new European Fiscal Authority financed by VAT receipts to oversee eurozone government finances.

In an article published in Monday's New York Review of Books, Mr Soros said that Germany should become a more "benevolent" leading country or exit the single currency: "Either alternative would be better than to persist on the current course." …

July 2012 External Trade

Last week’s trade report from Matrade showed continued weakness in external demand for Malaysian products. As I thought they might, my July forecasts came in above realisation (log annual and monthly changes; seasonally adjusted):

Seasonally adjusted exports in July came in –1.2% on the year and –6.7% on the month, while imports were up 9.3% and 2.0% in log terms.

Friday, September 7, 2012

World Debt Clock

I stumbled on this last night going through my RSS feeds:

The global debt clock

Our interactive overview of government debt across the planetThe clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar to anyone who has been to Times Square in New York, where the American public shortfall is revealed. Our clock (updated September 2012) shows the global figure for almost all government debts in dollar terms.

Follow the link to view – it’s not just a clock, there’s also an interactive heat map, where you track public debt by totals, as ratios or in terms of growth; from 2001 to EIU forecast data for this year and next. Hovering your mouse over the map on a country prompts a tooltip that shows public debt data for that country in that particular year. There’s even a country comparison tool.

It’s nice toy to play with, if you’ve an interest in public debt, and cross-country comparisons generally

Yes, Minister; No, Minister

I was alerted to this yesterday by a reporter. Sometimes I wonder…do our politicians do any fact checking at all, or do they just pluck figures out of the air?

Our esteemed Deputy Minister of Finance needs some help (excerpt):

Govt to spend on devt, keep debt manageable, says Deputy Finance Minister

KUALA LUMPUR: The government will have to continue spending on development while at the same time keeping national debt at a manageable level, says Deputy Finance Minister Datuk Donald Lim Siang Chai…

…As at December 2011, the ratio of national debt to the gross domestic product (GDP) reached 51.8%.

Talk Boldly And Carry A Small Stick

The ECB has taken out its big guns, but conveniently forgot to take the safeties off (excerpt, emphasis added):

Introductory statement to the press conference

Mario Draghi, President of the ECB,

Vítor Constâncio, Vice-President of the ECB,It is against this background that the Governing Council today decided on the modalities for undertaking Outright Monetary Transactions (OMTs) in secondary markets for sovereign bonds in the euro area. As we said a month ago, we need to be in the position to safeguard the monetary policy transmission mechanism in all countries of the euro area.

BNM Watch: OPR Still On Hold

The statement at the conclusion of yesterday’s Monetary Policy Committee meeting was a model of brevity in stating the obvious:

At the Monetary Policy Committee (MPC) meeting today, Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 3.00 percent.

The global growth momentum has moderated. Economic activity in most major advanced economies is slower amid greater policy uncertainty while conditions in the international financial markets continue to be volatile. These developments are affecting growth in the rest of the world. In emerging economies including in Asia, domestic demand is showing signs of moderation amid sustained weakness in external activity.

Thursday, August 30, 2012

Mythbusting: Government Debt Edition Part II

Well, I’m back from my break and had a lovely time with family and friends – back to regularly blogging again.

Nevertheless, this wouldn’t have been my chosen topic, but with the budget little more than a month away, I suppose its understandable.

In a column yesterday at the Malaysian Insider, Azrul Mohd Khalib repeats all the same old myths about Malaysia’s government debt (excerpt; emphasis added):

Maxing out the national credit card

…Every national Budget over the past few years has had a deficit. When total national expenditure exceeds the revenue collected, a budget deficit then exists. The only way for the government to pay for this deficit is to borrow.

Thursday, August 16, 2012

July 2012 CPI: Still Retreating

Tucked between the news on GDP, the latest consumer price index numbers show inflation continuing to decelerate (log annual and monthly changes):

The overall index is down, core inflation increased slightly on the month, but was offset by a decrease in the pain index. In fact the annual rate of increase in food and transport prices is now at its slowest pace in more than two years (since March 2010).

2Q 2012 National Accounts: Surprise, Surprise

What a nice lead up to the holidays. While I thought 2Q GDP might turn out to be pretty good, 5.4% annual growth is outside all my expectations (log annual and seasonally adjusted annualised quarterly changes; 2005=100)

Seasonally adjusted quarterly growth has been pretty solid too at 5.9%, holding up above 5.7% for three straight quarters.

Friday, August 10, 2012

June 2012 Industrial Production

Yesterday’s report on June’s industrial production numbers were mildly disappointing (log annual and monthly changes; seasonally adjusted)

Wednesday, August 8, 2012

June 2012 External Trade

There’s quite frankly not going to be a whole lot of posts until the week after Hari Raya, just a few quick ones on data releases as they come. With luck something like normal posting volume should resume after the Raya break.

Today’s releases of last month’s trade numbers weren’t terribly inspiring (log annual and monthly changes; seasonally adjusted):

Although exports registered an increase of 5.3% y-o-y in log terms, that’s well below the double-digit growth projections from both my models.

Thursday, July 26, 2012

Mythbusting: Government Debt Edition

Teh Chi-Chang of Refsa was on BFM radio the other day promoting his new book:

I sometimes feel like I’m banging my head against a wall.

Tuesday, July 24, 2012

Illicit Outflows: Here We Go Again

Another report to add on to the GFI report on global illicit fund flows a year or so back:

Malaysia lost RM893b in illicit outflows, research shows

KUALA LUMPUR, July 22 ― A colossal RM893 billion was siphoned out of Malaysia’s economy into tax havens abroad between 1970 and 2010, a London-based research has revealed, placing the country among the top 20 nation in the developing world labelled as “losers” of capital flight.

The sum is more than triple that of Malaysia’s national debt total, which amounted to RM257.2 billion in 2011, according to previous media reports.

Monday, July 23, 2012

Dissension In The Ranks

Reuters gets the scoop (excerpt, H/T BBC):

IMF economist accuses Fund of suppressing information

WASHINGTON, July 20 (Reuters) - A veteran economist at the International Monetary Fund has accused the global lender of suppressing information on difficulties in dealing with the global financial meltdown and euro zone crisis.

In a resignation letter to the IMF's board and senior staff, dated June 18, Peter Doyle said the IMF's failures in issuing timely warnings for both the 2007-2009 global financial crisis and the euro zone crisis were a "failing in the first order" and "are, if anything, becoming more deeply entrenched."

His letter, a copy of which was seen by Reuters, has brought to light simmering tensions within the IMF over the Fund's credibility, which many worry is threatened by its role in the euro zone crisis.

Friday, July 20, 2012

A Singaporean Mystery

I was alerted to something quite interesting a few days ago by warrior 231 – there appears to be hole in the Singapore government accounts, a fairly substantial one.

The one man crusader pursuing this issue is Christopher Balding, Associate Professor at Peking University’s HSBC Business School. Here’s a sampling from his blog:

The Importance of Economic Capture and Government Surpluses

…However, if we add in GIC numbers, everything begins to fall apart. As I have already covered in previous posts, we actually know pretty closely how much GIC manages. In March 2011, with Temasek declaring its holding at $193 billion SGD and the government holding cash of $125 billion SGD, the balance sheet reveals a GIC upper bound estimate of $387 billion SGD, pretty close to outside estimates…

Thursday, July 19, 2012

Fixed Exchange Rates: Better Close That Capital Account

In the latest round of research from the NBER, this paper describes some “surprising” results (abstract):

Pegs, Downward Wage Rigidity, and Unemployment: The Role of Financial Structure

Stephanie Schmitt-Grohé, Martín UribeThis paper studies the relationship between financial structure and the welfare consequences of fixed exchange rate regimes in small open emerging economies with downward nominal wage rigidity. The paper presents two surprising results. First, a pegging economy might be better off with a closed than with an open capital account. Second, the welfare gain from switching from a peg to the optimal (full-employment) monetary policy might be larger in financially open economies than in financially closed ones.

June 2012 CPI: Prices Ticking Up Again

After a four month hiatus, consumer prices are on the upswing again (log annual and monthly changes; 2000=100):

Wednesday, July 18, 2012

The Optimal Rate Of Inflation

We’re on a optimisation binge today. After the last post on international reserves, here’s a piece on the optimal level of inflation (abstract; emphasis added):

How Inflation Affects Macroeconomic Performance: An Agent-Based Computational Investigation

Quamrul Ashraf, Boris Gershman, Peter HowittWe use an agent-based computational approach to show how inflation can worsen macroeconomic performance by disrupting the mechanism of exchange in a decentralized market economy. We find that increasing the trend rate of inflation above 3 percent has a substantial deleterious effect, but lowering it below 3 percent has no significant macroeconomic consequences. Our finding remains qualitatively robust to changes in parameter values and to modifications to our model that partly address the Lucas critique. Finally, we contribute a novel explanation for why cross-country regressions may fail to detect a significant negative effect of trend inflation on output even when such an effect exists in reality.

The Optimal Level Of International Reserves

East Asia over the years have been variously accused of currency manipulation and neo-merchantilist policies. Massive reserve holdings in the region – e.g. China’s USD3.2 trillion, Japan’s USD1.3 trillion; nine of the top twenty reserve holdings are in East Asia - can be pointed to as proof of this assertion.

A new research paper in this month’s NBER circulation disputes this view however (abstract; emphasis added):

Optimal Holdings of International Reserves: Self-Insurance against Sudden Stop

Guillermo A. Calvo, Alejandro Izquierdo, Rudy Loo-KungThis paper addresses the issue of the optimal stock of international reserves in terms of a statistical model in which reserves affect both the probability of a Sudden Stop–as well as associated output costs–by reducing the balance-sheet effects of liability dollarization. Optimal reserves are derived under the assumption that central bankers conservatively choose reserves by balancing the expected cost of a Sudden Stop against the opportunity cost of holding reserves. Results are obtained without using calibration to match observed reserves levels, providing no a priori reason for our concept of optimal reserves to be in line with observed holdings. Remarkably, however, observed reserves on the eve of the global financial crisis were–on average–not distant from optimal reserves as derived in this model, indicating that reserve over-accumulation in Emerging Markets was not obvious. However, heterogeneity prevailed across regions: from a precautionary standpoint, Latin America was closest to model-based optimal levels, while reserves in Eastern Europe lay below optimal levels, and those in Asia lay above. Nonetheless, there are other motives for reserve accumulation: we find that differences between observed reserves and precautionary-motive optimal reserves are partly explained by the perceived presence of a lender of last resort, or characteristics such as being a large oil producer. However, to a first approximation, there is no clear evidence supporting the so-called neo-mercantilist motive for reserve accumulation.

Monday, July 16, 2012

What Happens When Public Debt Gets Too High

It doesn’t always result in a Greek tragedy, but high public debt (defined as exceeding 90% of GDP) results in a lower growth trajectory for, in most cases, over a decade (abstract, emphasis added):

Debt Overhangs: Past and Present

Carmen M. Reinhart, Vincent R. Reinhart, Kenneth S. RogoffWe identify the major public debt overhang episodes in the advanced economies since the early 1800s, characterized by public debt to GDP levels exceeding 90% for at least five years. Consistent with Reinhart and Rogoff (2010) and other more recent research, we find that public debt overhang episodes are associated with growth over one percent lower than during other periods. Perhaps the most striking new finding here is the duration of the average debt overhang episode. Among the 26 episodes we identify, 20 lasted more than a decade. Five of the six shorter episodes were immediately after World Wars I and II. Across all 26 cases, the average duration in years is about 23 years. The long duration belies the view that the correlation is caused mainly by debt buildups during business cycle recessions. The long duration also implies that cumulative shortfall in output from debt overhang is potentially massive. We find that growth effects are significant even in the many episodes where debtor countries were able to secure continual access to capital markets at relatively low real interest rates. That is, growth-reducing effects of high public debt are apparently not transmitted exclusively through high real interest rates.

Shadow Education

Via the Edge, the Asian Development Bank has issued a new report on shadow education (excerpt):

Shadow Education: Private Supplementary Tutoring and Its Implications for Policy Makers in Asia

In all parts of Asia, households devote considerable expenditures to private supplementary tutoring. This tutoring may contribute to students’ achievement, but it also maintains and exacerbates social inequalities, diverts resources from other uses, and can contribute to inefficiencies in education systems.

Such tutoring is widely called shadow education, because it mimics school systems. As the curriculum in the school system changes, so does the shadow.

This study documents the scale and nature of shadow education in different parts of the region. For many decades, shadow education has been a major phenomenon in East Asia. Now it has spread throughout the region, and it has far-reaching economic and social implications.

Friday, July 13, 2012

The Policy Relevance Of Economics

My old boss, Radzuan Halim, on why economics remains relevant (The Edge; excerpt):

THE economics profession has been much criticised, maligned and parodied in recent years over its failure to predict the US mortgage-cum-economic crisis of 2008/09 and the ongoing Greek-euro crisis. Two reasons have been suggested for the failure. First is the economics methodology itself, which is based on the "rationality of man" assumption and its over-mathematisation — the takeover by quantitative-types not grounded in empirical reality and historical perspective.

Second, the profession has become so riddled with ideology that it determines an economist's findings and prescriptions…

…Of course, economics is by no means the only profession to be caught up in ideological partisanship and posturing…

…With respect to methodology, many economists do acknowledge the weakness of excessively quantitative approaches and have sought improved methods…

…Given the controversies and perceived weaknesses in the profession and methodology, my view is that present-day economics still offers good and sometimes, extremely good, approaches to the study of man's economic, social and political problems. Basic economic concepts and tools provide powerful, insightful analysis of situations, causes and policy prescriptions. By the same token, the absence or neglect of basic economic tools in analysing economic situations could lead to stagnation, deterioration and crisis, such as the situation found in present-day Greece and many other countries…

It’s a fairly long essay, with some good points and a few (from my point of view) bad ones – governments are not like households. But on the whole it offers a defense for using economic concepts and ideas to evaluate policy and in public discourse. Not a bad read, considering he’s not an economist.

Talking About Crime: Why Are We Focusing On Enforcement?

I was listening to BFM radio this morning with some bemusement – there was a fairly long discussion regarding the latest crime statistics report from Pemandu (excerpt):

Pemandu: Crime index down by 10.1% from January to May

KUALA LUMPUR: Malaysia's crime index fell by 10.1% between January and May this year, Pemandu said on Thursday.

According to figures released by Pemandu's Reducing Crime NKRA director Eugene Teh, there were 63,221 cases between January and May this year compared to 70,343 cases recorded in the corresponding period last year.

“The NKRA's focus on bringing down the crime rate in the last three years has achieved big wins yearly since we first began the Government Transformation Programme and the trend seems to be continuing,” he said.

Teh added that Index Crime dropped by 11.1% from 177,520 in 2010 to 157,891 in 2011. Index Crime are classified as Property Crimes which include theft, snatch theft, vehicle theft, machinery theft and house break-ins and Violent Crimes which are robbery, assault, rape and murder.

Street Crimes have also seen a noticeable drop with 38,030 in 2009 dropping by 39.7% to 22,929 in 2011...

Thursday, July 12, 2012

May 2012 Industrial Production

The latest IPI numbers posted a pleasant surprise (log annual and monthly changes; seasonally adjusted):

Wednesday, July 11, 2012

Estimating Government Waste

Oh boy, I know a lot of people are going to have a field day with this one (abstract):

Quality of Government and Living Standards: Adjusting for the Efficiency of Public Spending

Grigoli, Francesco ; Ley, EduardoSummary: It is generally acknowledged that the government’s output is difficult to define and its value is hard to measure. The practical solution, adopted by national accounts systems, is to equate output to input costs. However, several studies estimate significant inefficiencies in government activities (i.e., same output could be achieved with less inputs), implying that inputs are not a good approximation for outputs. If taken seriously, the next logical step is to purge from GDP the fraction of government inputs that is wasted. As differences in the quality of the public sector have a direct impact on citizens’ effective consumption of public and private goods and services, we must take them into account when computing a measure of living standards. We illustrate such a correction computing corrected per capita GDPs on the basis of two studies that estimate efficiency scores for several dimensions of government activities. We show that the correction could be significant, and rankings of living standards could be re-ordered as a result.

Tuesday, July 10, 2012

Joe Stiglitz And The Price Of Inequality

Nobel Prize laureate Joe Stiglitz is on Econtalk this week:

Nobel Laureate Joseph Stiglitz of Columbia University talks with EconTalk host Russ Roberts about the ideas in his recent book, The Price of Inequality. Stiglitz argues that the American economy is dysfunctional, benefitting only those at the very top while the bulk of the workforce sees little or no gain in their standard of living over recent decades. Stiglitz blames this result on deregulation and the political power of the financial sector and others at the top. He wants an increase in regulation and the role of government in the economy and a more transparent Federal Reserve Bank that he blames for coddling the financial sector. The conversation also includes a discussion of the Keynesian multiplier.

A fascinating discussion, made more so since the host of the show (Russ Roberts) holds substantially different views from Stiglitz, yet doesn’t turn the show into a Keynesian/Neo-Classical showdown. The site allows for both streaming and downloading the podcast (the interview’s over an hour long), and if you have even less time, a transcript of the highlights is also available at the bottom of the page.

Personally, I think Stiglitz is a little too quick to dismiss the capabilities of monetary policy, though he makes a relevant point about regulatory “capture”.

The book is currently available at Kinokuniya in KLCC (sorry, MPH doesn’t appear to carry it). Alternatively, you might want to try Amazon.

The Cost Of Buku Jingga

I’ve been asked by a friend to look at the numbers being bandied about regarding the cost of the proposals that a Pakatan Rakyat government would implement if it came into power, for example, as brought up in the recent debate between DAP’s Lim Guan Eng and MCA’s Chua Soi Lek (excerpt):

Pakatan’s call for change will bring uncertainty to the country, warns Soi Lek

…Dr Chua said the country would be bankrupt within two years of Pakatan's five-year tenure if it implemented all its pledges.

Even if the Pakatan could achieve 100% no-corruption and no-leakages, it might only save RM26bil; while its total pledges amounted to between RM200bil and RM230bil which is the country's total revenue in a year, he said.

Giving the breakdown of the figures, Dr Chua said this comprised between RM50bil and RM100bil for free toll, RM43bil for the abolition of PTPTN loans and RM93bil for the promise of the minimum monthly household income of RM4,000…

[If you click through the link, just ignore the very obvious spin in the article]

Since I don’t know the basis of the calculations on each side, and because Buku Jingga itself is rather short on details, an objective assessment is really out of the question.

Friday, July 6, 2012

Gold And Central Bank Fiscal Stimulus

I don’t know about you, but I don’t think I’d want to be taking investment advice from someone who doesn’t appear to know what he’s talking about (excerpt; emphasis added):

PETALING JAYA: Now is the time to invest in gold as its price is consolidating and likely to climb over the next few years, according to one expert of the commodity.

“Gold reached US$1,900 (RM6,042) last year but has fallen to US$1,600 now. This is a purely periodic correction,” said Dar Wong, a trader and veteran financial consultant who was the guest speaker at Tomei Consolidated Bhd's GoldSilver2U.com seminar…

…Gold, considered a safe haven in times of economic upheaval, has slipped some 15% since peaking at US$1,900.20 last September at the height of the eurozone crisis, but is up 2.7% for the year at yesterday's spot prices…

…He opined that this would come from two sources: inflation, which would force the hand of central banks to ease interest rates, and US monetary policy.

“Gold is traded in US dollars. Should the Federal Reserve decide on more fiscal stimulus, the weaker US dollar will push gold to new heights.

“From my studies, when the United States elects a new president after the third quarter, whoever gets the job will most likely put in a quantitative easing policy to consolidate his position. That will result in higher gold prices.”

Central banks, he added, had little choice in the current global scenario other than to loosen the reigns on fiscal policy.